Streamline Your Success: The Ultimate Commercial Loan Checklist Template

Ditch the application maze and secure your commercial construction loan with confidence! Our “Streamline Your Success” checklist template is your ultimate roadmap. This handy tool keeps you organized, ensuring you have all the crucial documents lenders need – from borrower information and property details to loan security and permits. No more scrambling for paperwork – focus on your vision while our checklist expedites your application review. Get the financing you deserve and turn your construction dreams into reality!

What are Commercial Loans?

Commercial loans are financial products specifically designed to meet the funding needs of businesses and corporations. Unlike personal loans which are tailored for individual use, commercial loans are intended for business purposes. These loans are offered by banks, credit unions, and other financial institutions, and they come with specific terms, conditions, and repayment schedules tailored to suit the needs of businesses.

Typical Uses of Commercial Loans:

- Business Expansion: Businesses often require additional funds to expand their operations, whether through opening new locations, purchasing equipment, or hiring more staff. Commercial loans provide the necessary capital for such growth initiatives.

- Real Estate Purchases: Many businesses require commercial real estate to operate, such as office buildings, retail spaces, or warehouses. Commercial loans can finance the acquisition or construction of these properties.

- Working Capital: To cover day-to-day operational expenses like payroll, inventory purchases, and utility bills, businesses may take out working capital loans. These loans help ensure smooth business operations without disrupting cash flow.

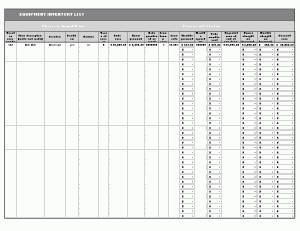

- Equipment Financing: Purchasing or leasing equipment can be expensive, especially for industries requiring specialized machinery. Equipment financing loans allow businesses to acquire necessary equipment while spreading out the cost over time.

- Inventory Financing: Retailers and wholesalers often use commercial loans to finance large inventory purchases, especially during peak seasons or when scaling up inventory levels.

- Debt Refinancing: Businesses may consolidate existing debts or refinance high-interest loans into a single, more manageable commercial loan with better terms, thus reducing overall interest costs.

Basic Commercial Loan Checklist Template

Small Business Loan Checklist Template

Commercial Real Estate Loan Checklist Template

← Previous Article

« Free Ledger Templates for Excel: Streamline Your Financial ManagementNext Article →

10+ Templates: Your Ultimate Resource for Petition Forms »