44 Free Tax and Non-Tax Invoice Templates: Perfect for Small Business Owners and Service Providers

If you’re a business owner or service provider, you know how important it is to keep track of your finances. That’s why you need a tax invoice – it’s an official accounting tool that helps you keep track of your sales. It includes important details like the products or services sold, their prices, and any discounts offered. To make things easier for you, we’ve got a bunch of tax invoice templates for you to download for free. There are 44 of them, in Microsoft Word, Excel, and PDF formats.

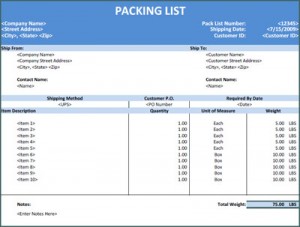

There are several important documents that are used for business purposes on a daily basis. If you are part of a business entity you must know that there are always some kind of buying and selling taking place in organizations. These transactions may not only be specified to retailing companies. Manufacturers and service providers may also buy and sell supplies to other stakeholders in the industry. One very important document that is used while making selling and buying transactions is called the sales invoice.

What is an Invoice?

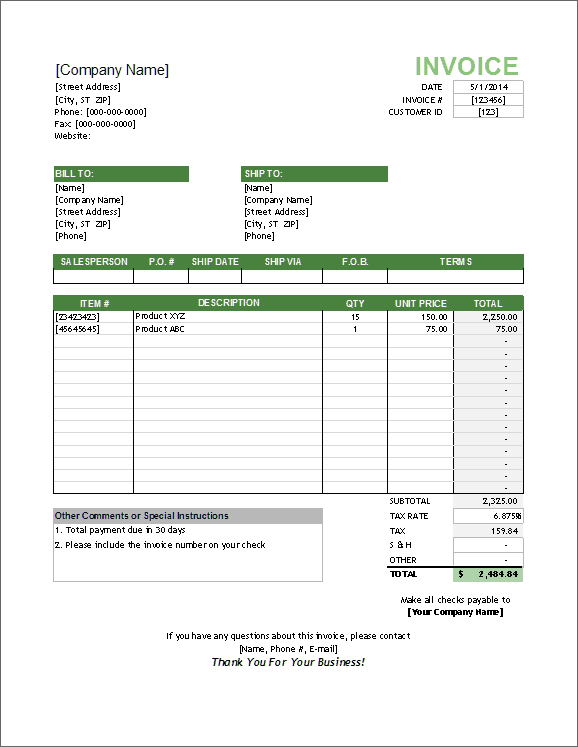

An invoice is not just a document of sales but it is essentially an accounting tool. It is utilized by an organization to make communication with the customer who is making a purchase or getting services. This document helps convey the written details of the products or services being bought. Some common elements added to an invoice include the following:

- Names of the products and services sold to the customer

- The prices of the products or services

- The respective quantities of the purchase

- Any rebates or discounts offered to the customer

- Any other terms and conditions of the transaction like mode of payment, advance payment, etc.

- Total amount received from the customer and the amount owed to the customer

Hence it can be stated that an invoice is a small statement of goods and services that is provided by a business to another entity. Every organization has its own invoice template. Whenever a sale is made the necessary additions are done to the sales invoice template.

Don’t Miss a Beat: 15 Vital Elements to Include in Your Tax Invoice

Having a clear and accurate tax invoice is essential for businesses and service providers for accounting and record-keeping purposes. In this section, we’ll outline the 15 key elements that should be included in a tax invoice to ensure it meets legal and regulatory requirements.

- Date of Invoice: The date the invoice is issued.

- Invoice Number: A unique identifier for the invoice.

- Seller’s Information: Name, address, and contact details of the seller.

- Buyer’s Information: Name, address, and contact details of the buyer.

- Description of Goods/Services: A brief description of the products or services sold.

- Quantity of Goods/Services: The quantity of the products or services sold.

- Price Per Unit: The price per unit of the products or services sold.

- Total Amount: The total amount payable by the buyer.

- Taxable Amount: The amount of tax charged on the products or services sold.

- Tax Rate: The rate of tax applied to the taxable amount.

- Total Tax: The total tax amount charged on the invoice.

- Grand Total: The total amount payable by the buyer, including taxes.

- Payment Terms: The terms and conditions of payment, including due date and mode of payment.

- Delivery Terms: The terms and conditions of delivery, including the date and mode of delivery.

- Signature: The signature of the seller or authorized person.

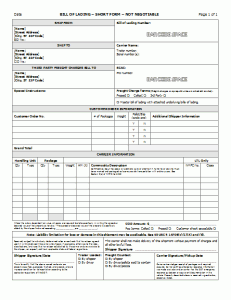

Choosing the Right Tax Invoice Type for Your Business

Choosing the right tax invoice type can help you stay compliant and maintain accurate records.Type of Invoice Best Usage Who can use Tips to use Standard Tax Invoice For registered GST taxpayers Businesses registered under GST Must include GST amount, unique invoice number, and date of issue Bill of Supply For businesses that are exempt from GST Businesses that are not registered under GST Should not include any GST amount or tax component Receipt Voucher For advance payments or partial payments Businesses that receive advance or partial payments Should mention that it is a receipt voucher, details of the advance or partial payment received, and the tax applicable Refund Voucher For refunding the money to the customer Businesses that need to refund money to the customer Should mention that it is a refund voucher, the amount being refunded, and the tax applicable

Downloading Free Tax Invoice Templates

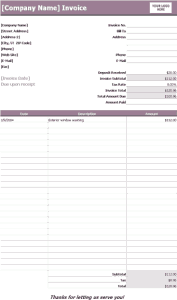

An invoice template varies from business to business or Service to service that is being delivered to a customer, and so does the template. Based on this need, we have collected some rapidly used templates created in Microsoft Word, Microsoft Excel, and Adobe PDF formats. Simply scroll down and choose the one that suits your needs the best, and download it for free! It’s that easy!

MS Word Invoice Templates

- Billing Invoice

- Blank Invoice 1

- Blank Invoice 2

- Blank Invoice 3

- Consulting Invoice

- Contractor Invoice 1

- Contractor Invoice 2

- General Invoice 1

- General Invoice 2

- Photography Invoice 1

- Photography Invoice 2

- Pro-Forma Invoice

- Sales Invoice

- Sample Invoice

- Service Invoice

- Simple Invoice

- Standard Invoice for Board of Education

- Standard Invoice for Department of Education

- Stock Photography Invoice

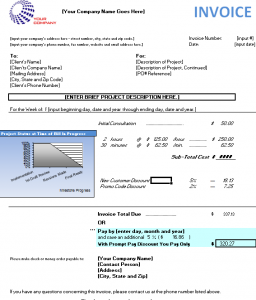

MS Excel Invoice Templates

- Basic Invoice 1

- Basic Invoice 2

- Billing Invoice

- Catering Invoice

- Commercial Invoice

- Consulting Invoice

- Freelance Invoice 1

- Freelance Invoice 2

- Freelance Invoice 3

- Freelance Invoice 4

- General Invoice

- Pro-Forma Invoice

- Sales Invoice 1

- Sales Invoice 2

- Detailed Service Invoice with Tax Calculations

- Simple Invoice

- Vat Invoice 1

- Vat Invoice 2

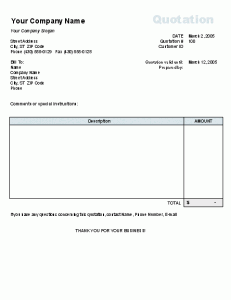

PDF Invoice Templates

- Detailed Commercial Invoice

- Editable Business Invoice

- Simple Invoice (Editable)

- Catering Invoice

- Trading Company Invoice

- Service Invoice

- Catering Invoice

Benefits of Using Tax Invoice Templates

Using tax invoice templates brings multiple benefits to your invoicing process. Here are the advantages you can enjoy:

- Streamlined process and time savings: Templates simplify invoicing, saving you time.

- Accurate recording of sales and transactions: Templates ensure precision in tracking financial details.

- Professional and organized image: Impress clients with well-designed, structured invoices.

- Compliance with tax regulations: Templates help meet tax requirements and documentation standards.

- Customization for branding and needs: Tailor templates to align with your business identity.

By leveraging tax invoice templates, you can streamline your invoicing, maintain accuracy, and project professionalism, comply with tax regulations, and customize templates to suit your branding and requirements.

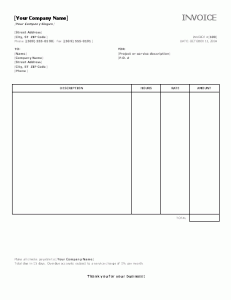

Customization: Personalize Your Tax Invoice Template

Here are some valuable tips for effectively utilizing tax invoice templates:

- Customize with your business details: Personalize the template by adding your company logo, name, address, and contact information. This enhances brand recognition and makes it easier for clients to reach you.

- Provide clear product or service descriptions: Ensure that each line item on the invoice includes a concise and accurate description of the items sold or services rendered. This helps clients understand what they are being charged for.

- Verify calculations and tax amounts: Double-check all calculations to avoid errors. Verify that tax calculations are accurate and align with the applicable tax rates. This helps maintain financial accuracy and prevents issues during audits.

- Maintain a record of invoices: Keep a systematic record of all generated invoices. This enables easy access for future reference, accounting purposes, and potential audits. An organized record-keeping system contributes to efficient financial management.

- Regularly update templates: Stay up to date with any changes in tax laws or business practices that may impact your invoicing process. Review and update your templates periodically to reflect these changes, ensuring compliance and accuracy.

By implementing these tips, you can maximize the effectiveness of tax invoice templates, maintain professionalism, minimize errors, and stay organized in your invoicing practices.

← Previous Article

« 16+ Professional Meeting Agenda Templates: Save Time & Stay FocusedNext Article →